The Evolution of Interest Rates: Your Guide to Confident Home Purchases

Are high-interest rates discouraging you from taking the leap into homeownership? Don't let those numbers deter you from your dreams. We’re exploring why they are currently high, the historical context behind them, and how you can make the most of the situation. Whether you're a first-time home buyer or a repeat home buyer, understanding interest rates is key to a confident home purchase.

Why Are Interest Rates So High?

Before we delve into the history of interest rates, it's essential to understand why they are currently on the higher side. They are influenced by several factors. These include economic conditions, inflation, and the Federal Reserve's monetary policy.

Economic Growth: In times of robust economic growth, interest rates tend to rise. This is because lenders can charge more when the demand for borrowing is high. South Dakota has seen steady economic growth in recent years, which contributes to the current environment.

Inflation: When prices for goods and services rise over time, it erodes the purchasing power of money. To combat this, the Federal Reserve may raise interest rates.

Federal Reserve Policy: The Federal Reserve has a significant influence on interest rates. It can raise or lower the federal funds rate, which, in turn, affects other interest rates, including mortgage rates. The Fed has been gradually raising rates to prevent the economy from overheating.

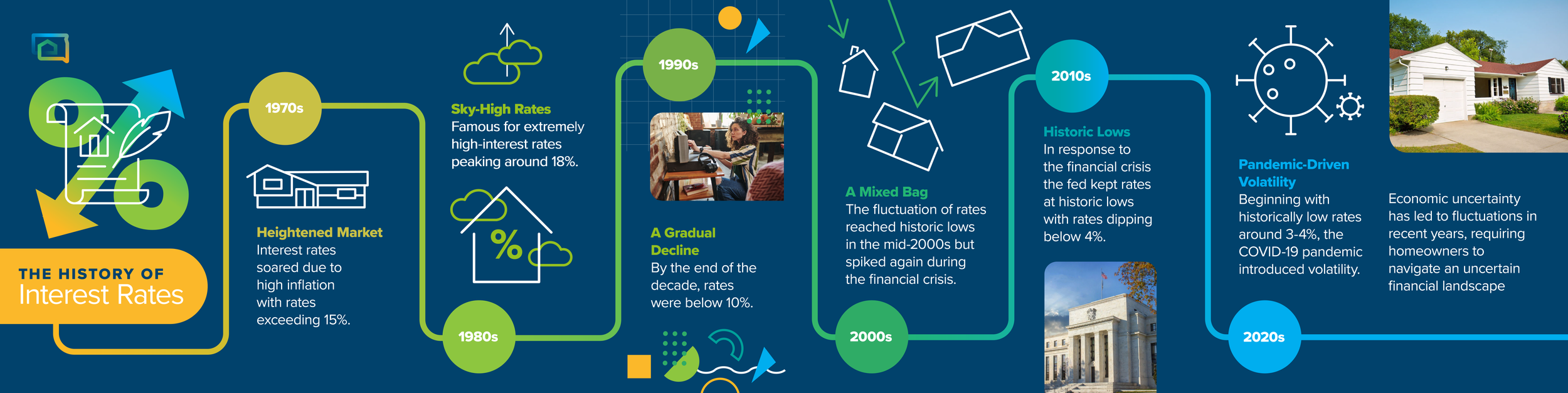

The History of Interest Rates

Let's take a journey through the history of interest rates. This historical perspective can provide valuable insights into today's rates:

1970s - Heightened Market: In the 1970s, interest rates soared due to high inflation. Mortgage rates reached astonishing levels, exceeding 15%. This was a challenging time for home buyers.

1980s - Sky-High Rates: The 1980s were infamous for extremely high-interest rates. Mortgage rates peaked around 18%. Fortunately, rates gradually declined throughout the decade.

1990s - A Gradual Decline: The 1990s saw a gradual decrease in interest rates, making homeownership more affordable. By the end of the decade, rates were below 10%.

2000s - A Mixed Bag: Interest rates fluctuated during the 2000s. The housing market boomed, and rates reached historic lows in the mid-2000s. However, they spiked again during the financial crisis.

2010s - Historic Lows: In response to the financial crisis, the Federal Reserve kept rates at historic lows throughout most of the 2010s. Mortgage rates dipped below 4%, making homeownership very attractive.

2020s - Pandemic-Driven Volatility: The 2020s began with historically low mortgage rates around 3-4%. However, the COVID-19 pandemic introduced unprecedented volatility, briefly pushing rates below 3%. Economic uncertainty led to fluctuations in recent years, requiring home buyers to navigate an uncertain financial landscape.

How to Take Advantage of High Mortgage Rates

Now that you have a historical perspective, you might wonder how to make the most of the current high-interest rates. Here are some strategies:

Lock in a Fixed-Rate Mortgage: Fixed-rate mortgages provide stability because your interest rate remains constant over the life of the loan. This can be especially beneficial in a high-rate environment, as you won't be affected by future rate hikes.

Consider a Shorter Loan Term: While shorter loan terms may come with slightly higher monthly payments, they often offer lower interest rates. You'll pay less in interest over the life of the loan, saving you money in the long run.

Shop Around for the Best Rate: Different lenders or financial institutions may offer slightly different rates, so it pays to shop around. South Dakota Housing can provide guidance on reputable lenders in the state.

Improve Your Credit Score: A better credit score can qualify you for lower interest rates. Take steps to boost your credit before applying for a mortgage.

What is the Interest Rate on a First-Time Home Buyer Loan?

If you're a qualifying first-time home buyer in South Dakota, you might be wondering about the current interest rates available for your home loan. Interest rates can vary depending on market conditions. To find the most up-to-date information on the interest rates offered by South Dakota Housing for first-time home buyers, visit our Interest Rates page. Here, you'll find the latest rates and valuable details to help you make an informed decision on your home purchase. Understanding these rates is crucial when planning your homeownership journey, so be sure to check regularly for any updates.

Begin Your Homeownership Journey

High-interest rates shouldn't deter you from buying a home. By understanding the reasons behind the current rates, appreciating the historical context, and implementing smart strategies, you can confidently pursue your homeownership dreams. South Dakota Housing is here to support you every step of the way. So, remember, whether you're a first-time home buyer or a repeat buyer, now can be a great time to make South Dakota your home.

Ready to explore your homeownership possibilities? Start by using our Mortgage Calculator. This powerful tool will help you estimate your monthly mortgage payments, including insurance and taxes, allowing you to plan your budget effectively.

Sources: